Cryptocurrency has taken the world by storm, revolutionizing the way we think about money and financial transactions. As a digital asset designed for secure online transactions, cryptocurrency offers a decentralized alternative to traditional fiat currencies. With the growing popularity and mainstream acceptance of cryptocurrencies like Bitcoin and Ethereum, more and more people are looking for ways to capitalize on this exciting new asset class. In this comprehensive guide, we’ll explore the top strategies for making money with cryptocurrency in 2024.

Understanding Cryptocurrency Basics

What is Cryptocurrency?

At its core, cryptocurrency is a digital or virtual currency that uses cryptography for security, making it nearly impossible to counterfeit. Unlike traditional fiat currencies, which are controlled by central banks, cryptocurrencies operate on decentralized networks, free from government intervention or manipulation.

Cryptocurrencies rely on blockchain technology, a distributed ledger system that records all transactions across a network of computers. This decentralized structure ensures transparency, security, and immutability, as no single entity can control or alter the blockchain.

Popular Cryptocurrencies to Invest In

While there are thousands of cryptocurrencies in existence, not all are created equal. When looking to invest in cryptocurrency, it’s essential to focus on projects with strong fundamentals, active development teams, and real-world utility. Some of the most popular cryptocurrencies to consider include:

- Bitcoin (BTC): The original and most well-known cryptocurrency, Bitcoin has the largest market capitalization and is often considered a store of value.

- Ethereum (ETH): The second-largest cryptocurrency by market cap, Ethereum is a decentralized platform for building and deploying smart contracts and decentralized applications (dApps).

- Altcoins: This term refers to any cryptocurrency other than Bitcoin. Popular altcoins include Litecoin (LTC), Ripple (XRP), and Cardano (ADA), among others.

Top Strategies to Make Money with Crypto in 2024

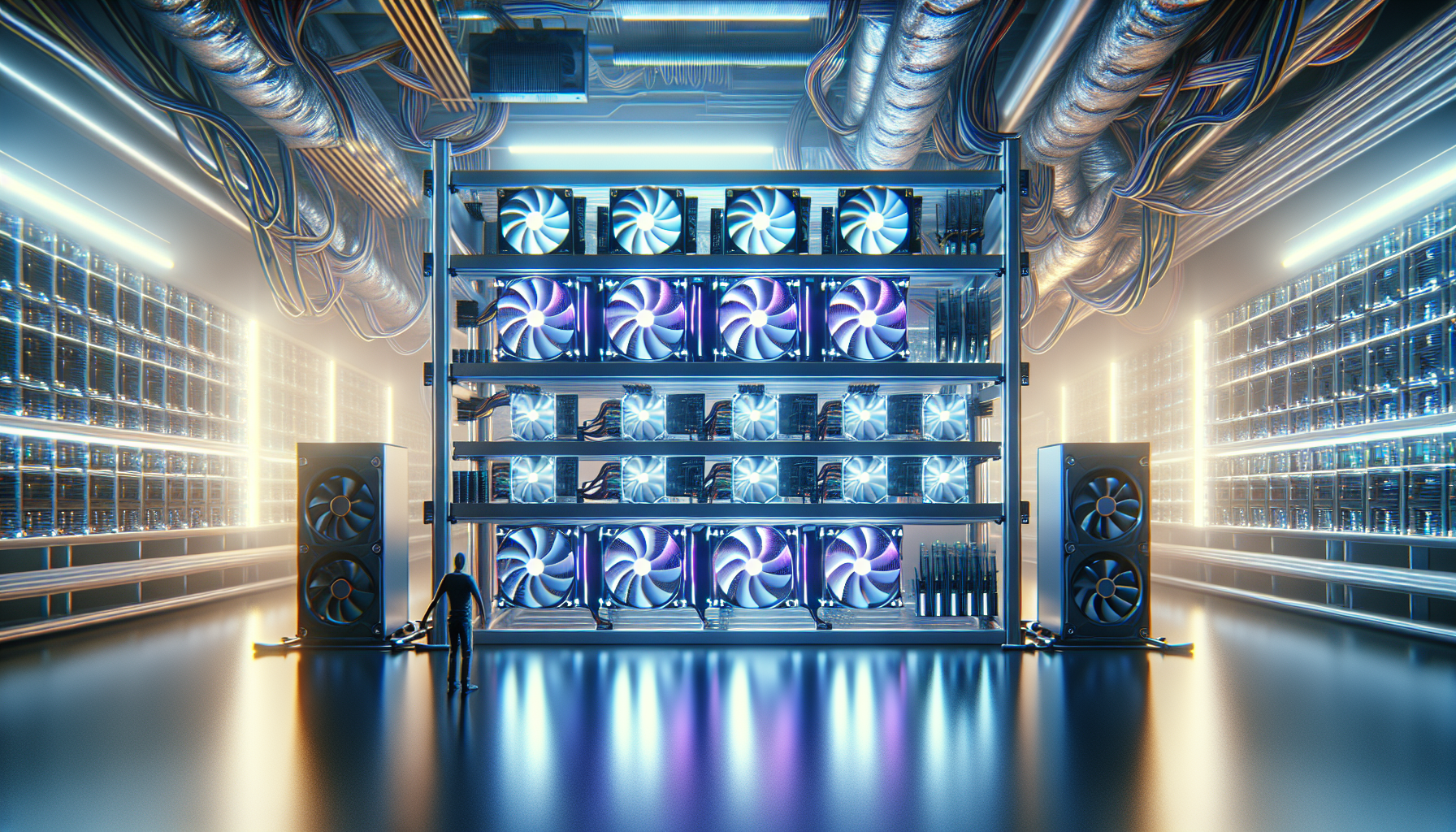

Cryptocurrency Mining

Cryptocurrency mining is the process of verifying transactions on a blockchain network and adding new blocks to the chain. Miners are rewarded with newly minted coins for their efforts, making it a potential way to earn cryptocurrency. However, mining can be resource-intensive, requiring specialized hardware and significant electricity consumption.

To start mining, you’ll need to invest in powerful computing equipment, such as application-specific integrated circuits (ASICs) or graphics processing units (GPUs). You’ll also need to join a mining pool, which combines the computing power of multiple miners to increase the chances of solving a block and earning rewards.

Staking Cryptocurrencies

Staking is an alternative to mining that allows users to earn rewards for holding certain cryptocurrencies in a wallet. This process is based on the proof-of-stake (PoS) consensus mechanism, where users “stake” their coins to validate transactions and secure the network.

To participate in staking, you’ll need to hold a minimum amount of the required cryptocurrency in a compatible wallet. The more coins you stake, the higher your chances of being selected to validate transactions and earn staking rewards. Some popular cryptocurrencies that support staking include Ethereum 2.0, Cardano, and Polkadot.

Trading Cryptocurrencies

Cryptocurrency trading involves buying and selling digital assets on crypto exchanges, with the aim of profiting from price fluctuations. To succeed in trading, you’ll need to develop a solid understanding of market dynamics, technical analysis, and risk management.

One popular trading strategy is to buy low and sell high, taking advantage of market volatility. This involves identifying undervalued cryptocurrencies, buying them at a low price, and selling them when the price appreciates. To make informed trading decisions, it’s essential to stay up-to-date with market news, analyze price charts, and use tools like moving averages and relative strength index (RSI).

Long-Term Investing in Cryptocurrencies

For those with a lower risk tolerance or a longer investment horizon, long-term investing in cryptocurrencies can be a viable strategy. This approach involves identifying promising projects with strong fundamentals and holding their tokens for an extended period, often referred to as “HODLing” in the crypto community.

To mitigate the impact of short-term price fluctuations, investors can employ a dollar-cost averaging (DCA) strategy, which involves investing a fixed amount of money at regular intervals, regardless of market conditions. This helps to smooth out the effects of volatility and potentially lower the average purchase price over time.

Lending Cryptocurrencies

Cryptocurrency lending platforms allow users to earn interest on their digital assets by lending them to borrowers. This process typically involves depositing your cryptocurrencies into a lending platform, which then lends them out to borrowers at a higher interest rate. The platform shares a portion of the interest earned with the lenders, providing a passive income stream.

When choosing a crypto lending platform, it’s crucial to consider factors such as interest rates, loan terms, and the platform’s reputation and security measures. Some popular crypto lending platforms include Nexo, BlockFi, and Celsius Network.

Yield Farming with Cryptocurrencies

Yield farming, also known as liquidity mining, is a strategy that involves lending or staking cryptocurrencies in decentralized finance (DeFi) protocols to earn rewards. By providing liquidity to these protocols, users can earn a share of the platform’s transaction fees, as well as additional tokens as incentives.

To participate in yield farming, you’ll need to deposit your cryptocurrencies into a DeFi protocol’s liquidity pool. The protocol then uses these funds to facilitate trades and loans, generating fees in the process. As a liquidity provider, you’ll receive a portion of these fees, as well as any bonus tokens offered by the protocol.

Participating in Crypto Affiliate Programs

Many cryptocurrency exchanges and platforms offer affiliate programs that allow users to earn commissions by referring new customers. By sharing a unique referral link with friends, family, or followers, you can earn a percentage of the trading fees generated by your referrals.

To maximize your earning potential through affiliate marketing, it’s essential to build a strong online presence and engage with your target audience. This can involve creating informative content, such as blog posts, videos, or social media updates, that educate people about cryptocurrency and encourage them to sign up using your referral link.

Investing in Initial Coin Offerings (ICOs)

Initial Coin Offerings (ICOs) are a way for new cryptocurrency projects to raise funds by selling their tokens to investors. By participating in an ICO, you can potentially acquire tokens at a discounted price before they are listed on exchanges, with the hope that their value will appreciate over time.

However, it’s important to note that ICOs are highly speculative and come with significant risks. Many ICO projects fail to deliver on their promises, and some may even be outright scams. Before investing in an ICO, conduct thorough due diligence, research the project’s team, roadmap, and whitepaper, and never invest more than you can afford to lose.

Important Considerations for Crypto Investing

Understanding the Risks of Crypto Investing

While the potential rewards of investing in cryptocurrencies can be significant, it’s crucial to understand the risks involved. Cryptocurrencies are known for their high volatility, with prices often experiencing dramatic swings in short periods. This volatility can be influenced by a variety of factors, including market sentiment, regulatory changes, and media coverage.

Additionally, the cryptocurrency market is not immune to manipulation, with bad actors sometimes engaging in practices like pump-and-dump schemes or spreading false information to influence prices. It’s also important to be aware of the prevalence of scams and fraud in the crypto space, such as fake ICOs or phishing attempts.

Staying Informed on Cryptocurrency Regulations

As cryptocurrencies gain mainstream attention, governments and regulatory bodies around the world are grappling with how to effectively regulate this new asset class. The regulatory landscape for cryptocurrencies is constantly evolving, with different countries taking varying approaches to oversight and legal classification.

To stay compliant and make informed investment decisions, it’s essential to keep abreast of the latest regulatory developments in your jurisdiction. This may involve consulting with legal and financial professionals, as well as monitoring official government channels and reputable news sources for updates on cryptocurrency regulations.

Keeping Your Cryptocurrency Secure

One of the most important aspects of investing in cryptocurrencies is ensuring the security of your digital assets. Cryptocurrencies are stored in digital wallets, which can be vulnerable to hacking, malware, or other security threats if not properly protected.

To keep your cryptocurrencies safe, it’s crucial to follow best practices for wallet security. This includes using strong, unique passwords, enabling two-factor authentication (2FA), and storing a portion of your funds in cold storage (offline) wallets for long-term holding. Additionally, be cautious when sharing your private keys or seed phrases, as anyone with access to this information can potentially steal your funds.

Helpful Tools and Resources for Crypto Investors

As the cryptocurrency market continues to evolve and mature, a growing number of tools and resources are available to help investors make informed decisions and stay ahead of the curve. Some of these include:

- Token Metrics: A platform that provides comprehensive cryptocurrency data and AI-powered investment analysis tools to help users identify promising investment opportunities and manage their portfolios.

- Cryptocurrency data aggregators: Websites and apps like CoinMarketCap, CoinGecko, and Messari offer real-time price data, market analytics, and news aggregation for a wide range of cryptocurrencies.

- Blockchain explorers: Tools like Etherscan and Blockchain.info allow users to view and analyze transactions, addresses, and smart contracts on various blockchain networks.

- AI-powered crypto analysis: Emerging technologies like artificial intelligence and machine learning are being leveraged to provide more accurate market predictions, sentiment analysis, and risk assessment for cryptocurrency investments.

By staying informed, utilizing the right tools, and employing a well-thought-out investment strategy, you can position yourself to capitalize on the exciting opportunities in the world of cryptocurrency. As always, remember to invest responsibly, diversify your portfolio, and never risk more than you can afford to lose.

See also: