Cryptocurrency has taken the world by storm in recent years, with digital assets like Bitcoin and Ethereum becoming household names. As the crypto market continues to grow and evolve, more and more people are looking to get involved. However, for beginners, the world of cryptocurrency can seem overwhelming and complex. In this comprehensive guide, we’ll walk you through everything you need to know to get started with cryptocurrency investing.

Understanding the Basics of Cryptocurrency

What is Cryptocurrency?

At its core, cryptocurrency is a digital or virtual currency that uses cryptography for security. Unlike traditional currencies, which are backed by governments or central banks, cryptocurrencies operate on decentralized networks, free from the control of any single authority. The most well-known cryptocurrencies include Bitcoin, Ethereum, and various altcoins (alternative coins).

One of the defining characteristics of cryptocurrencies is their volatility. Prices can fluctuate wildly from day to day, making them a high-risk, high-reward investment. While some investors have made substantial profits from crypto, others have suffered significant losses. It’s essential to understand the risks before investing any money.

How Blockchain Technology Powers Cryptocurrency

Cryptocurrencies are powered by blockchain technology, which functions as a decentralized ledger. This ledger records all transactions across a network of computers, ensuring transparency and security. Each block in the chain contains a record of multiple transactions, and once added to the chain, the data cannot be altered retroactively.

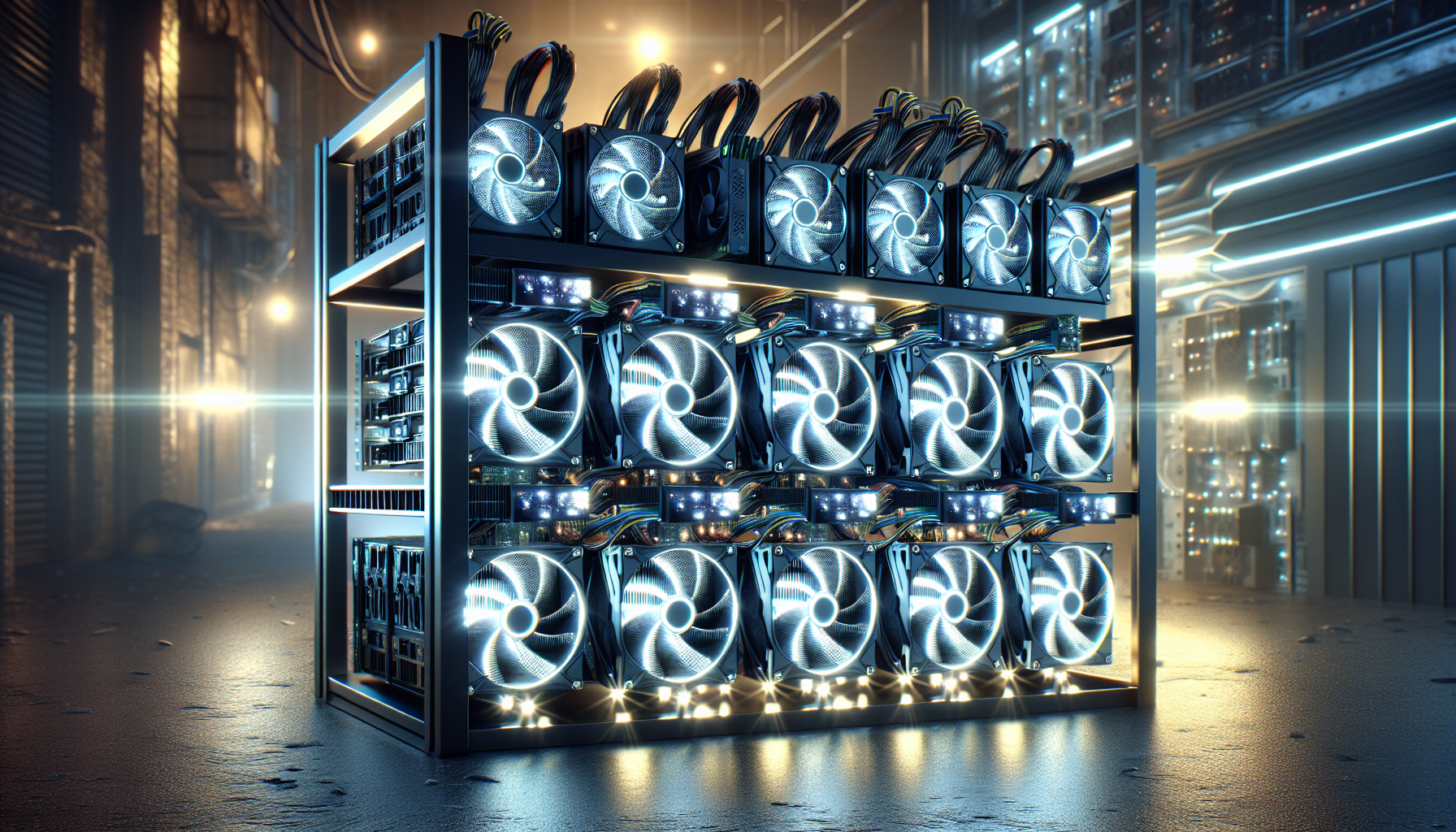

The verification process for transactions on the blockchain is known as crypto mining. Miners use powerful computers to solve complex mathematical problems, and in doing so, they validate transactions and add new blocks to the chain. In return for their efforts, miners are rewarded with newly minted cryptocurrency.

Preparing to Invest in Cryptocurrency

Assessing Your Financial Readiness

Before investing in cryptocurrency, it’s crucial to assess your financial stability. Ensure that you have an emergency fund in place to cover unexpected expenses, and that any high-interest debt is under control. Cryptocurrencies should only be a small part of a diversified investment portfolio, as their volatility makes them a high-risk asset.

Consider your risk tolerance and the amount of disposable income you have available for investing. Cryptocurrency should never be seen as a get-rich-quick scheme, and you should only invest what you can afford to lose. Think about your long-term financial goals, and how cryptocurrency fits into that picture.

Researching and Understanding Different Cryptocurrencies

Not all cryptocurrencies are created equal, and it’s essential to understand the investment case for each one before putting any money in. Some, like Bitcoin, are seen as a store of value, while others, like Ethereum, have more practical applications in the world of decentralized finance.

When researching a cryptocurrency, look beyond just the price history. Read the project’s white paper, investigate the team behind it, and try to understand its long-term roadmap. Fundamental analysis is key to making informed investment decisions in the crypto space.

Ways to Invest in Cryptocurrency

Buying Cryptocurrency Directly

The most straightforward way to invest in cryptocurrency is to buy it directly through a crypto exchange. Platforms like Coinbase, Kraken, and Binance allow users to buy, sell, and store a wide variety of cryptocurrencies. To get started, you’ll need to set up an account, verify your identity, and link a payment method.

Once you’ve bought your cryptocurrency, it’s essential to store it securely in a crypto wallet. There are two main types of wallets: hot wallets, which are connected to the internet, and cold wallets, which are offline. For long-term storage, cold wallets (like hardware wallets) are generally considered the safest option.

Alternative Investment Methods

For those who prefer not to buy cryptocurrency directly, there are several alternative investment methods available:

- Crypto futures: These are leveraged derivative contracts that allow investors to speculate on the future price of a cryptocurrency.

- Bitcoin ETFs: Exchange-traded funds that track the price of Bitcoin, offering exposure without the need to hold the cryptocurrency directly.

- Crypto stocks: Investing in companies that are involved in the cryptocurrency industry, such as exchanges or mining firms.

- Blockchain ETFs: Funds that invest in companies working on blockchain technology, the underlying infrastructure of cryptocurrencies.

Each of these methods comes with its own set of risks and rewards, and it’s important to thoroughly research any investment before committing funds.

Managing Risk in Cryptocurrency Investing

Strategies for Long-Term Investors

For those looking to invest in cryptocurrency for the long haul, there are several strategies to help manage risk:

- Buy and hold: This involves buying a cryptocurrency and holding onto it for an extended period, regardless of short-term price fluctuations.

- Dollar-cost averaging: Investing a fixed amount of money at regular intervals, rather than trying to time the market.

- Portfolio rebalancing: Periodically adjusting the proportions of different assets in your portfolio to maintain your desired level of risk.

These strategies can help to smooth out the volatility of the crypto market and reduce the impact of emotional decision-making.

Strategies for Short-Term Traders

For those looking to capitalize on short-term price movements, there are several trading strategies to consider:

- Technical analysis: Using charts and other tools to identify patterns and trends in price data, and making trades based on these signals.

- Market timing: Attempting to buy low and sell high by predicting future price movements.

- Stop-loss orders: Setting automatic sell orders to limit losses if the price of a cryptocurrency falls below a certain level.

While these strategies can be effective, they also carry a high level of risk. Short-term trading requires a significant time commitment and a deep understanding of market dynamics.

Tips for Beginner Cryptocurrency Investors

Prioritizing Security and Safety

One of the most important things for beginner cryptocurrency investors to prioritize is security. Cryptocurrencies are a popular target for hackers and scammers, and it’s essential to take steps to protect your investments:

- Use secure wallets, and keep the majority of your holdings in cold storage.

- Enable two-factor authentication on all of your accounts.

- Be aware of common scams, such as phishing emails and fake websites.

By taking these precautions, you can help to safeguard your cryptocurrency investments.

Staying Informed and Adapting to Market Changes

The cryptocurrency market is constantly evolving, with new projects, technologies, and regulatory developments emerging all the time. As an investor, it’s important to stay informed about these changes and adapt your strategy accordingly.

Follow reputable news sources and industry publications to keep up with the latest developments. Engage with the cryptocurrency community on forums and social media to gain insights and perspectives from other investors. By staying informed and being willing to adapt, you’ll be better equipped to navigate the dynamic world of cryptocurrency investing.

Remember, investing in cryptocurrency is a high-risk, high-reward endeavor. Start small, do your own independent research, and never invest more than you can afford to lose. With the right approach and a long-term perspective, cryptocurrency can be a valuable addition to a diversified investment portfolio.

See also:

- Best Cryptocurrency to Invest in 2024 – Top Picks for June

- How to Make Money with Cryptocurrency – Best Strategies in 2024

- What Happens if You Don’t Report Cryptocurrency on Taxes

- How to Buy Cryptocurrency for Beginners: A Step-by-Step Guide

- How Much Will Ethereum Be Worth in 2030? Ethereum (ETH) Price Predictions